income tax efiling malaysia

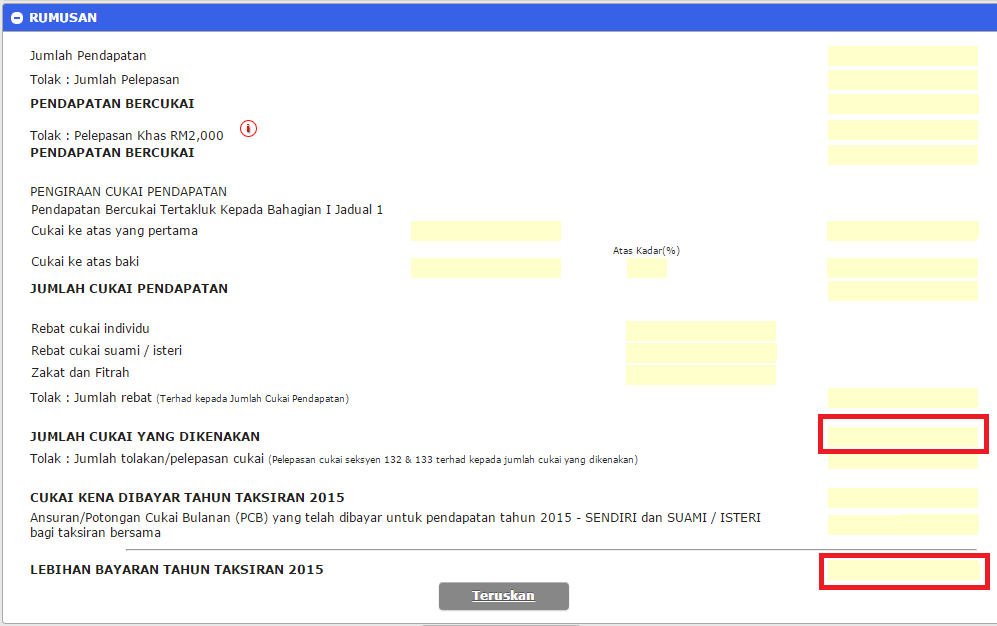

On the First 5000 Next 5000. However if you claimed RM13500 in tax.

How To Efile Your Income Tax Return And Wealth Statement Online With Fbr Toughnickel

Tax relief or tax exemption in Malaysia is a system established by the Inland Revenue Board of Malaysia LDHN whereby taxpayers are allowed to deduct a certain amount.

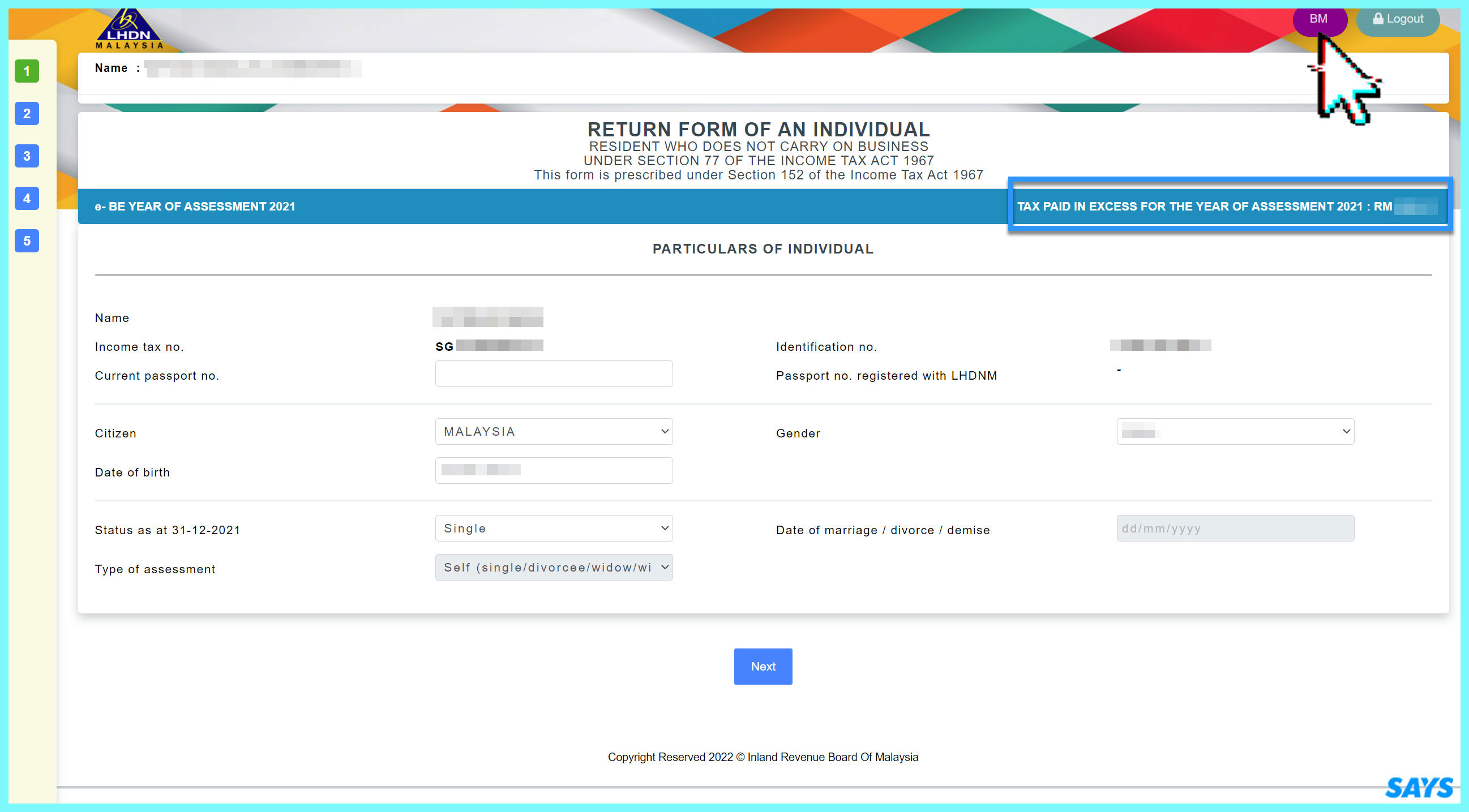

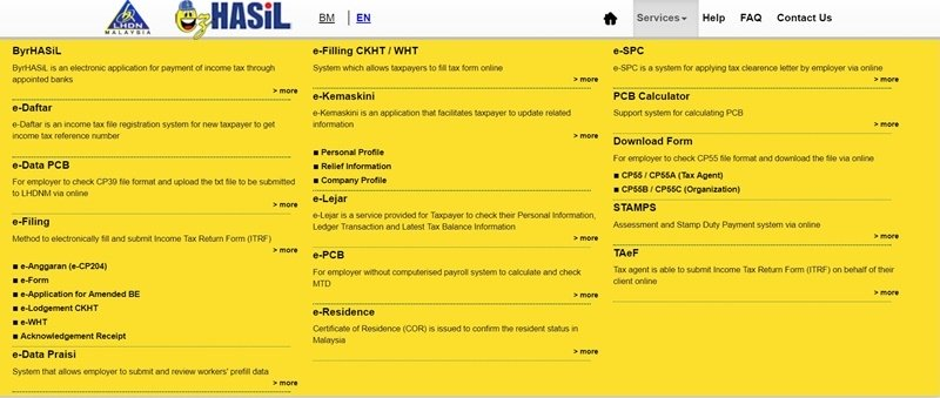

. Here are the steps to file your tax through e-Filing. At the various options available on the ezHASIL page choose the myTax option. You must be wondering how to start filing income tax for the.

Thereafter enter your MyKad NRIC without the dashes and key in your password. Based on this amount your tax rate is 8 and the total income tax that you must pay amounts to RM1640 RM600 RM1040. Go to e-filing website When you arrive at IRBs official website look for ezHASIL and click on it.

The IRB has published on its website the 2022 income tax return filing programme 2022 filing programme titled Return Form RF Filing Programme For The Year 2022 dated. Under Section 82A of the Income Tax Act 1987 you are required to keep such proofdocuments for up to 7 years from the end of the year of assessment. Dimaklumkan bahawa satu sesi penyenggaraan sistem bagi ezHASiL akan dilakukan pada 12 Oktober 2022 Rabu jam 0600 petang hingga 12 Oktober 2022 Rabu jam 1159 malam.

For the BE form resident individuals who do not carry on business the. If this is your first time. Calculations RM Rate TaxRM 0-2500.

The deadline for filing income tax in Malaysia also varies according to what type of form you are filing. If there are any problems with income tax efiling login malaysia check if password and username is written correctly. 1800 103 0025 or 1800 419 0025.

Head over to ezHASIL website. E-Filing Home Page Income Tax Department Government of India. 30042022 15052022 for e-filing 5.

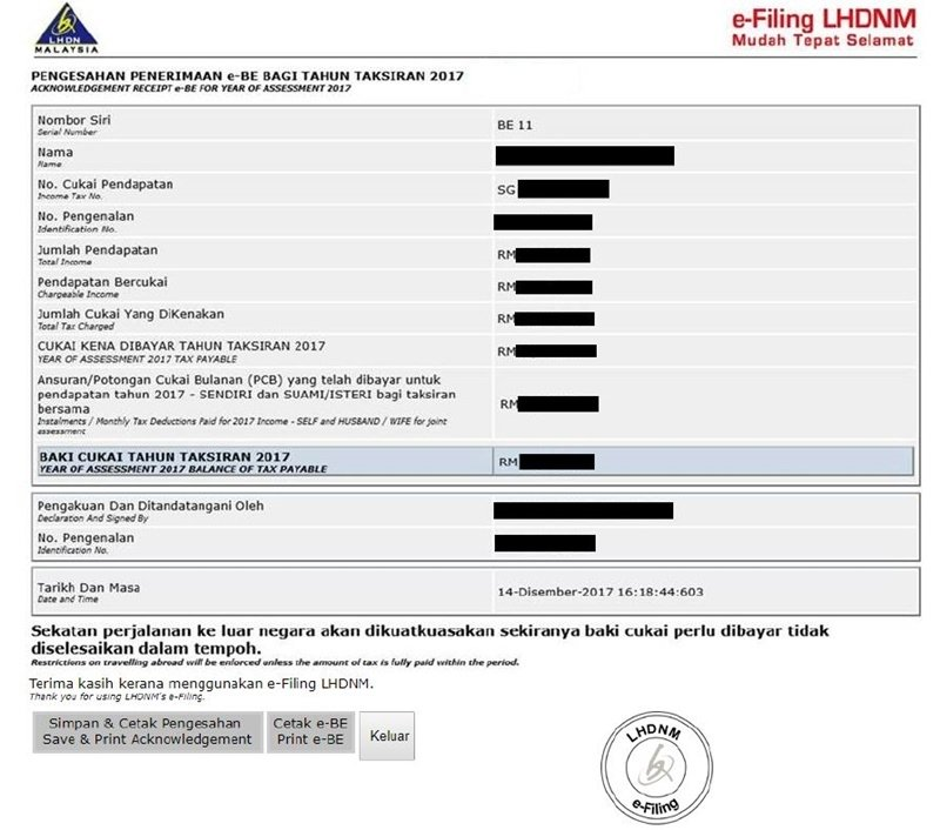

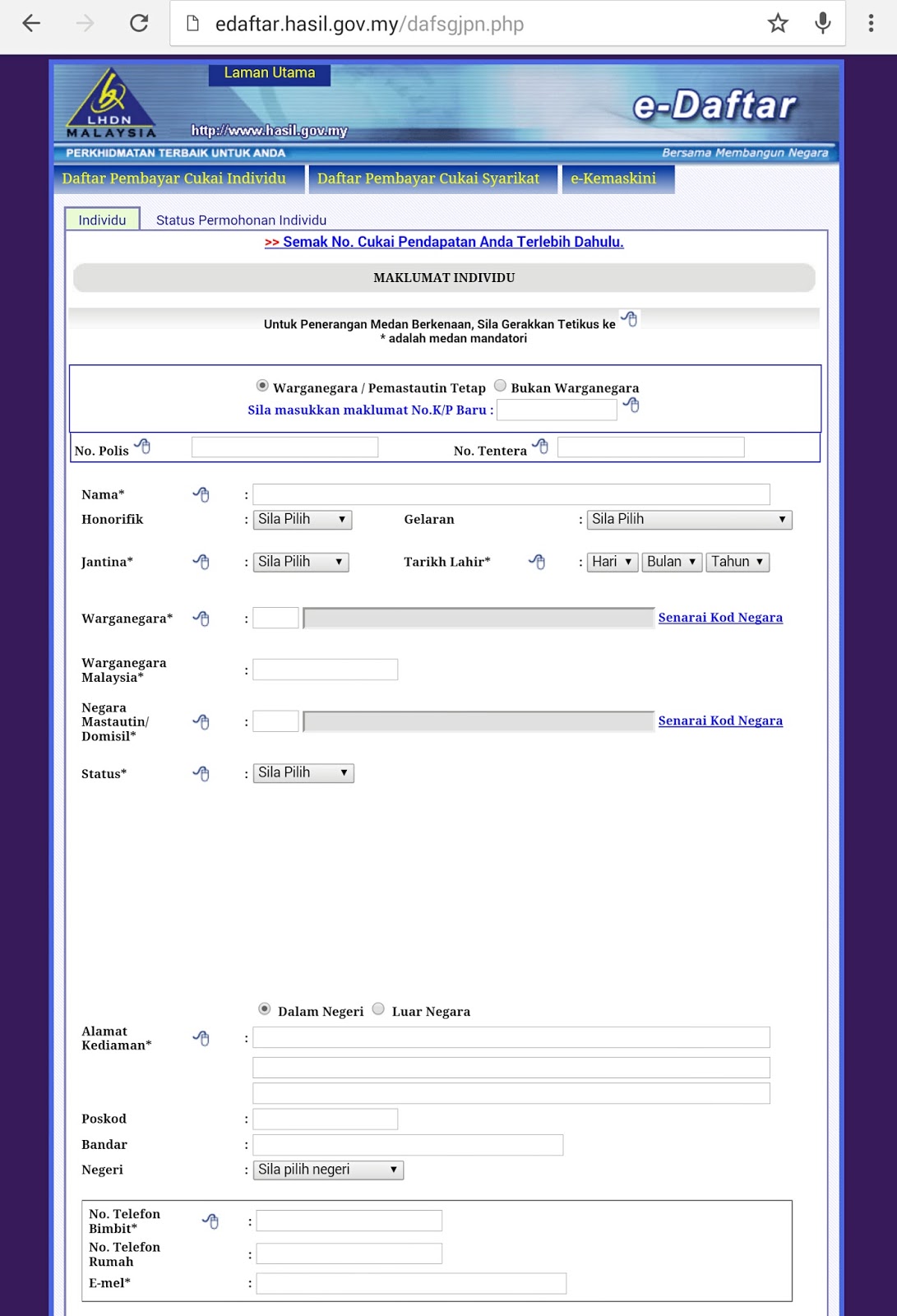

Bagi meningkatkan ketelusan dan penglibatan awam dalam pentadbiran cukai langsung Lembaga Hasil Dalam Negeri Malaysia HASiL mengalu-alukan orang ramai untuk menyertai. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber. Browse to ezHASiL e-Filing website and click First Time Login Fill up PIN Number and MyKad Number click Submit button Review all the information click Agree Submit button.

By Kian Ng 6 commonly asked questions with regards to personal income tax e-filing for first-time tax-payers. Head over to the ezHASIL website or MyTax LHDNs one-stop platform for all things tax-related. What Is Defined As Income.

You must pay income tax on all types of income. Income tax return for individual who only received employment income. Alternatively you can either check online via e-Daftar or give LHDN a call at 03.

Introduction Individual Income Tax. After registering LHDN will email you with your income tax number within 3 working days. The tax filing deadline for person not carrying on a business is by 30.

E-Filing of Income Tax Return or Forms and other value added services Intimation Rectification Refund and other Income Tax Processing Related Queries. Where to file your taxes in Malaysia Finally youre ready for the fun bit. Also you can contact with customer support and ask them for help.

Headquarters of Inland Revenue Board Of Malaysia. Malaysias personal income tax year is from 1 January to 31 December and income is assessed on a current year basis. How to File Income Tax in Malaysia 2022 LHDNAre you filing your income tax for the first time.

On the First 2500. Income tax return for individual with business.

Updated 2021 Tax Reliefs For Ya 2020 And How To File Income Tax In Malaysia Using Lhdn E Filing Iproperty Com My

How To Re Submit Your Income Tax Form If You Did It Wrong Malaysia Financial Blogger Ideas For Financial Freedom

Guide To Using Lhdn E Filing To File Your Income Tax

Ctos Lhdn E Filing Guide For Clueless Employees

Malaysia Personal Income Tax Guide 2020 Ya 2019

Just An Ordinary Girl How To Do E Filing For Income Tax Return In Malaysia

How To File Income Tax For The First Time

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Malaysia Personal Income Tax Guide 2020 Ya 2019

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

Tis The Season To File Your Taxes Again So We Thought We D Help You Out With E Filing Rojakdaily

Business Income Tax Malaysia Deadlines For 2021

Income Tax Malaysia 2021 E Filing How To Register For Ezhasil E

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

How To File Income Tax In Malaysia Using E Filing Mr Stingy

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

Business Income Tax Malaysia Deadlines For 2021

9 Income Tax Ideas Income Tax Income Tax

Psa Lhdn Extends Income Tax Filing Deadline To 30th June Soyacincau

Comments

Post a Comment